UnionDigital Bank (UD), the digital arm of Union Bank of the Philippines, is working to help millions of unbanked Filipinos gain access to financial services.

UD is focusing on first-time users who are often overlooked by traditional banks, such as sari-sari store owners, ride-hailing drivers, and daily wage earners. Through its “Kaya Mo” movement, the bank is making financial empowerment an achievable reality.

The “Kaya Mo” Movement is based on the idea that every Filipino can achieve their dreams using UnionDigital’s simple and easy financial tools. This initiative goes hand-in-hand with Usapang Diskarte, the bank’s financial literacy program designed to make money management practical and easy to understand.

During its consumer launch at Market! Market! in Taguig, UnionDigital introduced its financial products and services to the public, focusing on its payments and transfer features. The bank reaffirmed its promise: to provide a simple and perfect digital banking experience through one user-friendly app, where you can open an account in minutes and make seamless cashless payments.

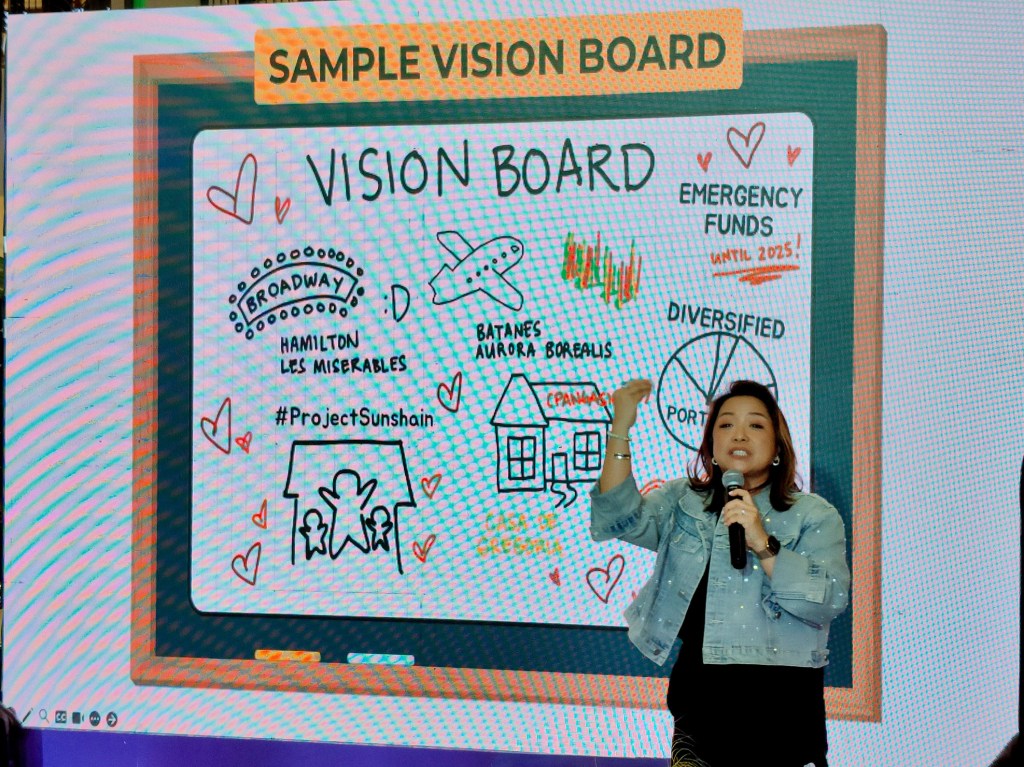

A key part of the launch event was an engaging Usapang Diskarte Financial Literacy Talk led by financial expert Salve Ibañez, also known as the “Financial Beshie ng Bayan.”

She stressed that financial empowerment is possible for everyone when they take control of their money. Ibañez shared practical tips on how to be smart with finances, making complex topics easy to understand and apply. With UnionDigital’s help, she noted, Filipinos can achieve anything.

Kaya Mo with UD’s Digital Banking Products and Features

The Kaya Mo Movement is built around UnionDigital’s updated app and its suite of financial products, all designed for the daily needs of Filipinos. These tools are meant to be a path toward financial empowerment.

- Payments and Transfers: The app offers convenient ways to manage your money. You can use InstaPay for transfers with no fees or limits, pay bills without waiting in line, and soon, use QRPH to scan and pay anywhere.

- New UD Virtual Debit Card (powered by VISA): This card gives you more control and security for online shopping. You can see your spending in real time, lock or unlock your account if it’s lost, and set custom spending limits to help you budget.

- UD Save: This simple savings account helps you reach your financial goals. It has no minimum balance and no maintenance fees, making it easy for first-time savers to get started. Plus, your money can grow faster with high-interest rates.

- UD Time Deposit: You can grow your money with competitive time deposit rates. You can open an account with as little as P1,000 and earn an interest rate of 3.75% per annum.*

*Interest rates may change. Updates will be posted on the UnionDigital website and app. Terms and conditions apply.

CongTV for UnionDigital Bank

A major highlight of the launch was the introduction of UD’s newest brand ambassador, Cong TV, a beloved figure who rose from humble beginnings as a vlogger to becoming one of the country’s most beloved entertainers. Embodying the Kaya Mo spirit with his personal journey resonating deeply with UD’s mission, Cong TV testified that with hard work and the right financial tools, Kaya Mo.

CongTV recalled, “Nagsimula ako nung 2008 sa YouTube. Ang saya-saya ko na sa 300 subscribers! I had a leap of faith when I quit my full-time job after 2 years; tapos naisipan kong seryosohin ang paggawa ng content. Sa totoo lang, for the first two years, hindi ako kumita ng pera—pero sa buhay, may halong swerte, kasama na ang ipinagkaloob ng Diyos sa’yo. By 2017, I started earning from YouTube. Pero sa ganitong klaseng trabaho, walang kasiguraduhan, kaya naging ma-diskarte ako sa pag-ipon at pag-budget ng kita ko.”

“Through the years, napalago ko ang pera ko, sa tulong na rin ng financial tools and services ng katulad ng UnionDigtal Bank. Kaya excited talaga ako sa partnership na ‘to. Masasabi ko talagang kung kaya ko, kaya mo rin,” CongTV declared.

“Kwentong Kaya Mo”

To encourage Filipinos to pursue their financial dreams, UnionDigital has launched an online campaign. From August 23 to September 15, 2025, everyone is invited to share their personal stories of financial success using the hashtag #KwentongKayaMo on social media. The five most compelling stories will receive special recognition and rewards from UnionDigital.

The “Kaya Mo” Movement is at the heart of UnionDigital’s mission to improve the lives of Filipinos. The bank aims to make financial empowerment a reality for everyone by providing accessible digital tools and a clear understanding of what their customers need. UnionDigital is working to create a future where every Filipino can confidently manage their finances and build a secure and prosperous life. With UD, Kaya Mo.

For more information, visit www.uniondigitalbank.io.

Download the UD app now on the App Store, Play Store, or HUAWEI AppGallery by clicking here.

Leave a comment